About to submit a proposal on Kolabtree but worried about Value Added Tax (VAT)? Don’t know if it applies to you? We try to explain the details in the following article.

Is VAT applicable to me?

VAT is applicable to you only if you’re paying VAT to the government or if you’re a VAT registered business. Further, VAT is applicable to you if you are a freelancer based in any country within Europe or in Australia or Canada, and you are hired by a Client from these countries. You may be required to submit VAT to your government at the end of the tax year.

How to calculate VAT?

At Kolabtree, our system allows freelancers based in these countries to add VAT to their project fee so that the final invoice generated for their client is inclusive of VAT. We will provide you with invoice formats that you can use so that your invoices are compliant with the requirements of countries within the EU.

Important note for freelancers: Remember that Kolabtree will begin charging a service fee of 20% on your total fee including VAT.

How do I go about including VAT in my invoice?

It’s simple! Log in to your Kolabtree account and follow the steps below while submitting a proposal for any project.

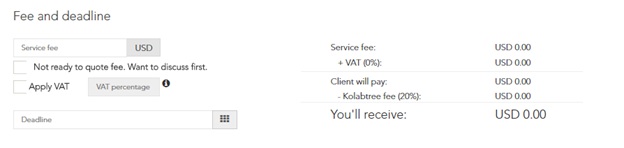

To apply VAT, click on “Apply VAT” under the “Fee and deadline” section when submitting a proposal. This will enable the “VAT percentage” field. Enter the VAT percentage applicable in your country. In case of doubt, you can read up more about VAT invoicing rules in Europe here. You can also look up VAT rules in Canada and Australia.

The VAT you add will automatically be configured in the adjacent fee table.

We’ve presented an example below to illustrate how VAT will be applied to the project cost quoted by a freelancer.

Proposal amount submitted by Freelancer = $300

VAT Rate added by Freelancer = 10% ($30)

Kolabtree Service Fee (will be calculated automatically) = 20%

Amount invoiced to client = $330 ($300 + $30 VAT)

Amount invoiced to Freelancer by Kolabtree = $330 * 20% = $66

Amount Freelancer Gets in e-Wallet = $264

*Note that as mentioned above, Kolabtree will charge a service fee of 20% on your total fee, including VAT.

Only freelancers residing in countries listed above can add VAT to their proposal amount. Further, VAT cannot exceed 26% of the final project cost.

Write to us at contact@kolabtree.com in case of any concerns.